Wind Power in Finland: With Subsidies and Without

The Finnish support scheme for wind energy

Since 2011, Finland has had an attractive subsidy scheme (the feed-in tariff scheme) targeted at the promotion of wind power and other renewable energy sources. The feed-in-tariff was granted to projects that managed to reserve their share of the available quota and were constructed in time to apply for a final approval into the scheme by November 2017.

A new support scheme in the form of a technology neutral tendering process was introduced just recently. Support will be made available for a total annual production of 1.4 TWh, corresponding to approximately 1.6% of Finland’s electricity consumption. Under the new scheme, the subsidy amount will be determined for each project in a competitive auction, which is anticipated for November and December of 2018.

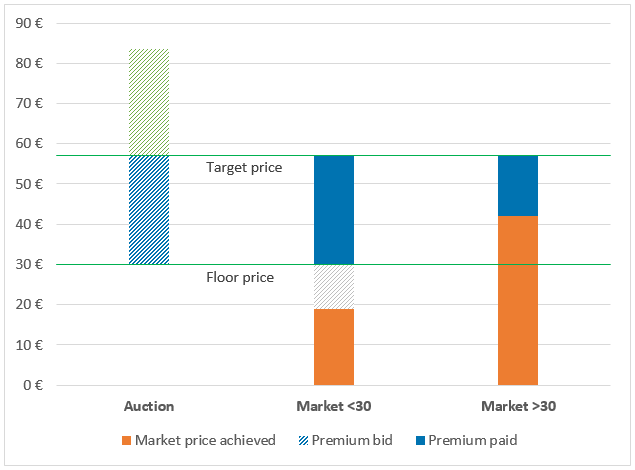

Based on a floor price of EUR 30/MWh, each bidder calculates the additional premium required to make the project feasible. Floor price plus premium make up the target price. The amount of premium to be paid under the scheme will depend on the average market price for the relevant calendar quarter. If the market price is below or equal to the floor price (EUR 30/MWh), the total premium amount awarded in the auction will be paid. If the market price exceeds the floor price, only the difference between market price and target price will be paid.

Projects are approved into the scheme on a pay-as-bid basis, meaning that the support granted to winning projects is based on their actual bid, rather than the highest bid eligible for support. Support will be granted for a maximum of 12 years.

In order to be eligible for support, projects need to fulfil certain preconditions similar to the existing support scheme. Furthermore, only fully permitted projects with a secured grid connection can participate in the bidding process. Participation is subject to a non-refundable fee and provision of a bidding security. The security will be released if the bid is unsuccessful. In case of the winning bid, the bidder has to replace the bidding security by a construction security within one month of the approval into the scheme.

Finally, the new scheme includes significant underperformance penalties in case the actual annual production stays below the annual production stated in the relevant bid.

Merchant projects and PPAs

Wind power is in general expected to fare well in the auction due to comparatively low production costs. On the other hand, the available support can only cover a small share of the projects currently under development. This makes the recent news about the first merchant projects all the more exciting.

In May 2018, Finnish developer TuuliWatti Oy announced their decision to build a 21 MW project in the municipality of Ii in western Finland without any government support. This was followed by news from CPC Finland Oy regarding the construction of a 50 MW project in Isojoki and wpd Finland Oy concerning a 60 MW unsubsidized project in Kannus.

The latter two projects will be implemented based on a corporate PPAs, i.e. long-term power purchase agreements with a corporate or industrial off-taker. For the off-taker, this type of agreement is a means of the corporate green agenda and sustainability goals as well as mitigating volatility in power prices. For the power producer, corporate PPA have the obvious advantage of securing long-term reliable revenues, thus making the project bankable without government support.

Given the emergence of business models such as corporate PPAs combined with advances in technology and beneficial wind conditions, it can be expected that the trend of merchant projects will continue on the Finnish market.